Deal Ready: Strengthening Your Firm’s Position for Private Equity or Acquisition

Why Private Equity (PE) is Investing in Accounting Private equity investments and merger activity have reshaped the accounting landscape. Between...

4 min read

Christine Hollinden : Jun 9, 2025 5:41:08 PM

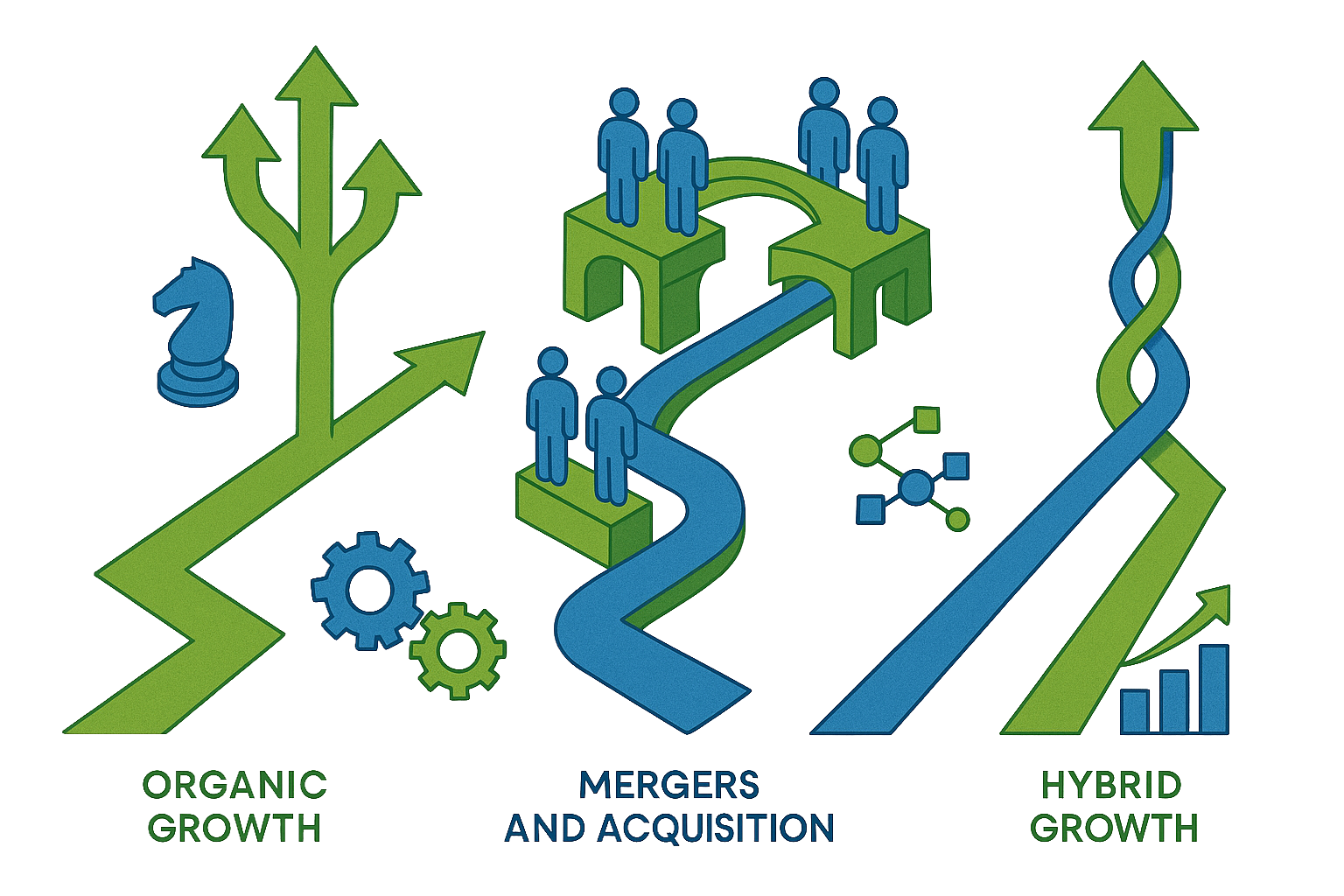

Mergers and acquisitions have become a common growth strategy in the mid-market accounting space. Whether the goal is to expand into a new geographic market, add niche service lines, or enhance talent pipelines, firms are turning to M&A as a quicker route to growth and competitive advantage. Yet, the majority of deals, over 70% according to several studies, fail to achieve their desired outcomes.

It’s not usually a matter of poor financials or flawed legal structures. Instead, it’s the integration phase, the critical months following a transaction, where the wheels often come off. Leaders are busy, cultures clash, clients feel forgotten, and employees grow uneasy. The result: value leakage, talent loss, client attrition, and internal disengagement.

Integration isn’t just about communication. It’s about alignment. Aligning people, systems, expectations, culture, and relationships. Without a deliberate plan and cross-functional execution, the best strategic rationale can unravel.

This article presents a five-step integration framework tailored for mid-market accounting firms, helping leaders bridge the gap between deal close and long-term success.

The success of integration is determined well before day one.

Planning should begin during the due diligence phase, not after the announcement. While financial and legal due diligence are essential, successful integration demands a holistic understanding of the businesses coming together.

Every transaction should be anchored in a clear strategic rationale:

Ensure leadership remains aligned on these goals throughout the integration process. When challenges arise, as they will, coming back to the “why” keeps decisions rooted in purpose rather than emotion.

Don't wait for the post-close chaos to discover operational landmines. A pre-close integration plan should map:

Beyond org charts and client lists lies the informal power grid: the internal influencers who shape morale and signal stability (or panic). Identify them early.

Similarly, document where client relationships live:

Doing this groundwork reduces surprises and helps retention planning.

Day One is more than a calendar date. It’s the firm’s first impression, internally and externally, of what this integration will feel like. Get it right, and you establish momentum. Fumble it, and skepticism spreads quickly.

Every audience including staff, clients, referral partners, and regulators, should hear a consistent message, delivered on a coordinated timeline. Mismatched explanations lead to confusion and erode confidence.

The message should:

Don’t leave communication solely to the C-suite. Partners, managers, and team leads should be prepared to communicate the change using language that resonates with both their teams and clients.

Pay special attention to:

Avoid over-hyped language or vague platitudes. People don’t expect perfection, they want clarity and confidence. Acknowledge the complexity while showing optimism. Make space for questions and input.

Virtual or in-person town halls, personalized client outreach, and one-on-one manager check-ins go a long way.

After the announcement, the real work begins.

Operational integration is where the firm must reconcile “how we used to do it” with “how we’ll do it now.” This phase can be messy but structured execution helps mitigate friction.

Start with areas that directly affect clients and employees:

Once client-facing elements are aligned, move to internal systems like HRIS, accounting software, and intranets.

Integration often requires adjusting reporting lines or merging teams. Be transparent about:

Uncertainty drives disengagement; clarity fosters trust.

Track how integration is being experienced across the firm:

Create mechanisms: surveys, feedback loops, steering committees, to capture these insights in real time.

Processes can be updated. Systems can be merged. But culture? Culture must be earned.

When two firms come together, they bring more than logos and spreadsheets. They bring values, rituals, and behaviors. Ignoring these elements is one of the most common (and costly) mistakes in integration.

Don’t treat one culture as the "winner" and the other as a relic. Instead:

Empower respected team members, at all levels, to model the new culture. Give them tools and platforms to promote collaboration, reinforce shared values, and address uncertainty.

Peer influence is often more powerful than top-down edicts.

Team trust doesn’t happen by default. Prioritize:

If possible, bring people together physically. Shared experiences create stronger bonds than shared memos.

It’s tempting to declare success after a few smooth weeks. But true integration takes months—sometimes years.

Without intentional reinforcement, old behaviors resurface, confusion lingers, and momentum stalls.

Build in formal reviews at 30, 90, and 180 days post-integration. These should evaluate:

Use these reviews to adjust direction, re-engage leaders, and celebrate wins.

Once internal operations and culture stabilize, refresh the firm’s external messaging:

Consistency breeds confidence for clients, recruits, and partners.

It’s easy to view M&A as a financial and legal exercise. But the real work, the work that determines success, happens after the papers are signed.

For accounting firms, integration isn’t just about combining spreadsheets and logos. It’s about aligning people, systems, cultures, and relationships in a way that feels purposeful, clear, and energizing.

Leaders who approach integration as a core part of the growth strategy will not only preserve the value of the deal but multiply it.

Growth through acquisition, private equity investment, or service line expansion is never just a transaction, it’s a transformation. At Hollinden, we guide accounting and advisory firms through the complexity of strategic growth, from pre-deal planning to post-deal integration.

Let’s make your next move your best move.

The Hollinden Point of View brings you monthly insights tailored to helping you grow your firm.

Why Private Equity (PE) is Investing in Accounting Private equity investments and merger activity have reshaped the accounting landscape. Between...

Mergers and acquisitions (M&A) and private equity (PE) investments are powerful accelerators of growth. They can provide access to new markets, bring...

Growth in professional services is never accidental. Unlike product-based companies that can rely on distribution, scale, or inventory, professional...