Growth Strategy for Professional Services

Growth in professional services is never accidental. Unlike product-based companies that can rely on distribution, scale, or inventory, professional...

3 min read

Christine Hollinden : May 23, 2025 3:49:39 PM

Organic, Acquisition, or PE-Backed—Which Path Will You Choose?

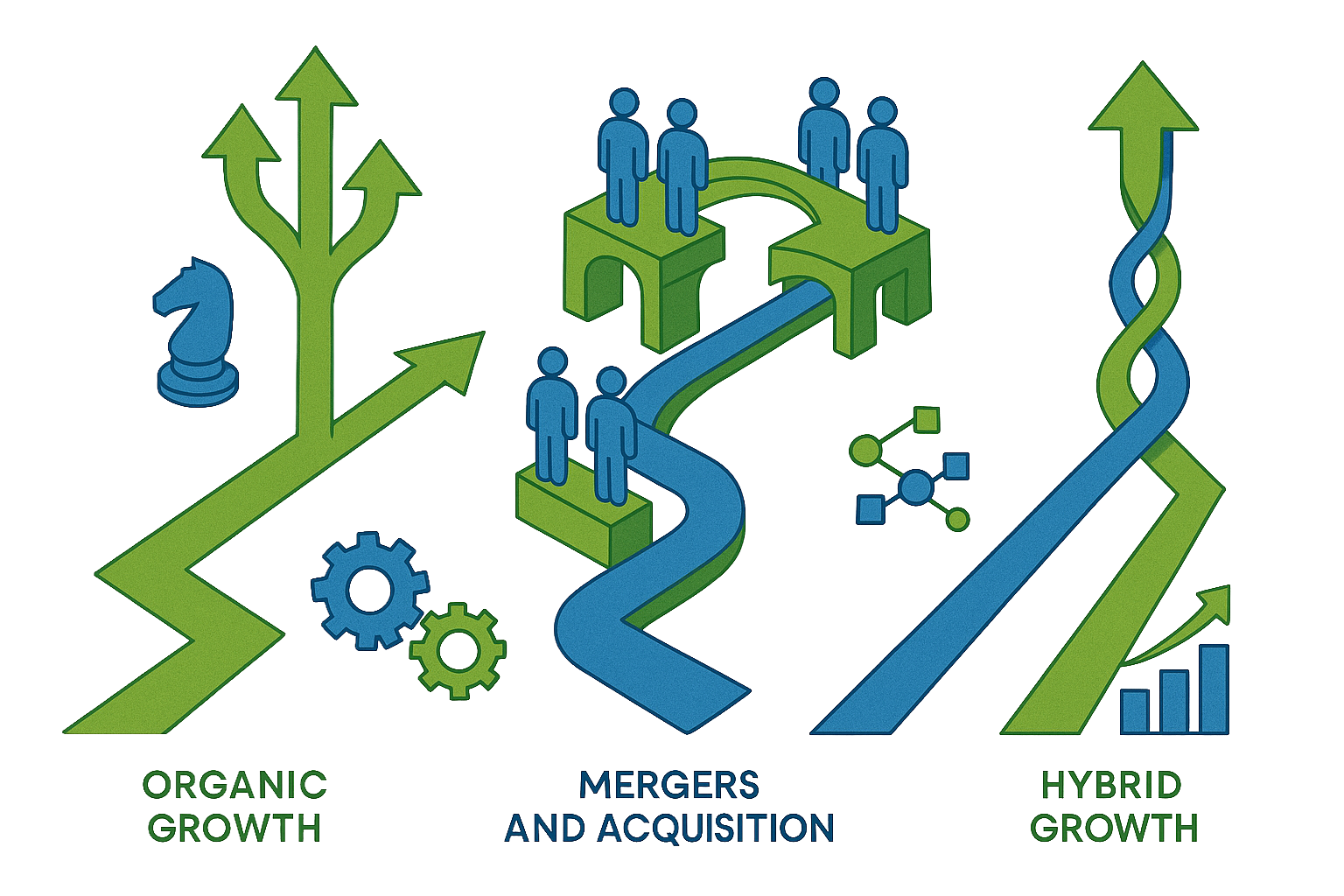

Growth isn’t optional—especially for professional services firms looking to increase market share, expand service offerings, or deepen value for clients. But with evolving economic conditions, increasing competition, and accelerating innovation, the real question is how will your firm grow?

Over the next 12 months, your firm’s strategic growth plan will determine its trajectory. Will you focus on organic growth, pursue strategic acquisitions, or seek private equity (PE) backing to scale faster? Each path presents opportunity—but also risk. Let’s explore each strategy and how to determine which is right for your firm.

Organic growth—expanding revenue without mergers, acquisitions, or outside investment—remains the backbone of long-term business success. It’s powered by marketing, innovation, and client retention.

Control: You maintain full ownership and autonomy over your firm’s direction.

Culture: Growth is aligned with your existing team values and operational DNA.

Sustainability: With proper strategy, organic growth can be more sustainable and less volatile than other models.

If you're in an accounting, wealth management, or consulting firm, examples of organic growth could include:

Expanding services into ESG advisory or tech consulting.

Deepening relationships with current clients through cross-selling or new offerings.

Investing in marketing to increase brand awareness in niche markets.

Launching content-driven campaigns to build thought leadership and generate leads.

If your firm has a strong client base, brand equity, and internal capabilities—but limited desire to relinquish equity or integrate another firm—organic growth may be your ideal strategy. However, it often requires a robust, consistent marketing effort and operational discipline to scale efficiently.

Acquisition allows firms to scale quickly by purchasing another firm’s assets, talent, and clients. For many accounting, investment banking, and consulting firms, acquisition is a powerful route to market expansion or capability enhancement.

Speed: Gain access to new markets, clients, or geographies nearly overnight.

Expertise: Add specialized talent or services to strengthen your portfolio.

Scale: Reach economies of scale faster, often improving margins.

Integration: Cultural alignment and communication are critical. Without them, post-acquisition performance can suffer.

Valuation Accuracy: Paying the right price and structuring a smart deal is crucial for ROI.

Client Retention: Ensuring clients of both entities feel valued during and after the transition is essential.

Imagine a regional accounting firm acquiring a boutique advisory firm to offer valuation and M&A services. Or a private wealth firm absorbing a tech-forward competitor to modernize its digital client experience. These moves can reshape brand perception and revenue potential.

If your firm is experiencing slowed growth, needs new capabilities, or wants to move into a new market quickly—and you have the operational infrastructure to support a successful integration—acquisition may be the path forward.

Tip: Conduct a growth-readiness audit before pursuing a deal. Is your leadership team aligned? Is your brand strategy ready to support growth without confusion?

Private equity investment is no longer just for large corporations. Increasingly, PE firms are targeting middle-market and professional services firms with strong fundamentals and growth potential.

Capital: Access to funding allows for tech upgrades, talent acquisition, and geographic expansion.

Expertise: Many PE partners bring deep operational knowledge and strategic insights.

Scale: PE backing can support multiple roll-up acquisitions or rapid infrastructure growth.

Pressure: PE firms expect results. Fast.

Loss of Autonomy: Strategic decisions may require investor approval or be driven by board mandates.

Cultural Impact: If your firm values independence or a collaborative culture, private equity oversight may require cultural adaptation.

Let’s say your firm has hit a growth plateau. You have a loyal client base, a talented team, and proven offerings—but you need capital to scale your digital transformation or expand into new markets. Partnering with a PE firm can unlock these goals faster than bootstrapped growth.

Another scenario? A PE firm funds a growth plan that includes multiple small acquisitions over 18 months, positioning your firm for a future exit or national presence.

If your firm has strong revenue, leadership depth, and scalable operations—but needs outside capital to grow aggressively—private equity might be a good match. Just be sure your goals and values align with your PE partner.

When determining your strategy, consider:

| Factor | Organic Growth | Acquisition | PE-Backed Growth |

| Control over decisions | High | Medium | Low to Medium |

| Speed of growth | Moderate | High | High |

| Risk level | Low to Medium | Medium | Medium to High |

| Capital requirements | Low | High | PE-provided |

| Internal capability | High needed | High needed | Medium to High |

| Ideal for firms that... | Want autonomy | Want new services or markets | Are ready to scale fast |

Use this matrix as a starting point. And remember: the best strategy may involve blending models—e.g., organic growth now while positioning for a strategic acquisition next year.

Growth for growth’s sake rarely pays off. Your 12-month growth plan should align with your:

Firm vision: Where do you want to be in 3–5 years?

Core capabilities: What are you known for? What can you scale?

Market trends: Are there opportunities to lead in innovation, digital transformation, or niche services?

At Hollinden, we help firms align growth strategy with marketing, leadership, and business development initiatives. Whether you’re refining your organic approach, preparing for a merger, or evaluating PE partners, we’ll help position your firm for success—with strategy, storytelling, and structure.

Let’s talk. We’ll help you uncover what’s possible—and what’s next.

The Hollinden Point of View brings you monthly insights tailored to helping you grow your firm.

Growth in professional services is never accidental. Unlike product-based companies that can rely on distribution, scale, or inventory, professional...

As accounting and advisory firms grow, complexity is inevitable. What starts as a small, nimble team can quickly turn into a slow-moving operation if...

For middle-market accounting firms, growth is both an opportunity and a necessity. A $20 million firm with five offices has already built a strong...