Deal Ready: Strengthening Your Firm’s Position for Private Equity or Acquisition

Why Private Equity (PE) is Investing in Accounting Private equity investments and merger activity have reshaped the accounting landscape. Between...

3 min read

Christine Hollinden : May 2, 2025 3:20:03 PM

In the high-pressure world of accounting, investment banking, and private equity, leaders make hundreds of decisions each day — some small, others critical to the future of their firms. Yet few recognize the silent, accumulating threat undermining these choices: decision fatigue.

Left unmanaged, decision fatigue can erode judgment, lead to costly mistakes, and drain organizational momentum. But leaders who recognize and address it gain a powerful strategic edge — both personally and across their firms.

In this article, we’ll explore how decision fatigue shows up in service firm leadership, how to spot it in yourself and your team, and the proven strategies you can deploy to safeguard your firm’s decision-making strength.

While decision fatigue can impact anyone, it strikes financial services leaders particularly hard. Here’s why:

High-stakes environment: In accounting, investment banking, and private equity, a single poor decision can cost millions, damage reputations, or derail careers.

Relentless decision volume: Leaders navigate client demands, compliance complexities, portfolio evaluations, and internal management daily — each requiring cognitive investment.

Constant context switching: Moving between tax audits, acquisition negotiations, investor relations, and HR matters taxes the brain’s executive function, draining mental resources faster than deep focus on one area.

The more decisions you make — especially under pressure — the more likely you are to suffer from reduced cognitive control and increasingly reactive, lower-quality decisions.

Understanding the signs of decision fatigue is critical to addressing it before it takes a toll on your firm’s performance.

When decision fatigue spreads across leadership teams and departments, the entire firm’s strategic agility and execution suffer.

Unchecked decision fatigue doesn’t just slow your firm down — it quietly damages your business on multiple fronts:

For example, imagine a private equity team deep in diligence on an acquisition target. After weeks of late nights, they overlook a subtle but material compliance risk buried in the legal documents. Post-close, the issue surfaces — costing millions in remediation and reputational damage. Fatigue, not incompetence, was the root cause.

Fortunately, decision fatigue isn’t inevitable. Strategic leaders can build resilience against it — both for themselves and their teams — with these five steps:

Focus your energy on decisions that truly move the needle for the firm: major investments, critical hires, strategic partnerships.

Delegate or automate lower-stakes decisions. Routine approvals, scheduling, and low-risk choices should not drain executive attention.

Standardize playbooks, checklists, and templates for common processes: client onboarding, audit risk assessment, M&A screening.

Structured frameworks reduce mental strain by guiding analysis and ensuring consistency, freeing up cognitive resources for creative and critical thinking.

Tackle important decisions early in the day when mental energy is highest.

Avoid back-to-back critical meetings. Build in mental breaks to recharge and maintain decision quality.

Reserve "deep work" time on calendars — and guard it fiercely.

Train mid-level managers on structured decision-making models like SWOT analysis, risk assessment, and decision trees.

Empower teams to recommend solutions, not just raise problems, minimizing unnecessary escalation.

Celebrate sound decision processes, not just successful outcomes, to reinforce good habits.

Encourage short mental breaks between major tasks.

Normalize behaviors that sustain cognitive endurance: hydration, movement, quality sleep, and even strategic use of caffeine.

Create a culture where "mental fitness" is as valued as technical expertise.

Beyond personal strategies, leaders must shape a firm-wide culture that distributes decision-making intelligently:

When decision-making is distributed strategically, organizations move faster, adapt better, and suffer less cognitive burnout at the top.

In the intense world of accounting, investment banking, and private equity, mental energy is a critical asset. Leaders who treat decision fatigue seriously — in themselves and their teams — strengthen their firms against costly mistakes, slow execution, and competitive drift.

Combating decision fatigue isn’t about making fewer decisions. It’s about making space for better decisions.

Audit your current habits. Strengthen your team’s capabilities. Build an environment where high-quality thinking is protected and prized.

The firms that win long-term aren’t necessarily the smartest — they are the ones that stay sharp, even when the stakes are highest.

Want to quickly assess your risk of decision fatigue — and start implementing high-impact changes?

Download our free Leadership Decision Health Checklist and uncover:

The Hollinden Point of View brings you monthly insights tailored to helping you grow your firm.

Why Private Equity (PE) is Investing in Accounting Private equity investments and merger activity have reshaped the accounting landscape. Between...

The accounting firm of 2030 will look drastically different than the firm of today. Compliance work will be largely automated. Advisory services will...

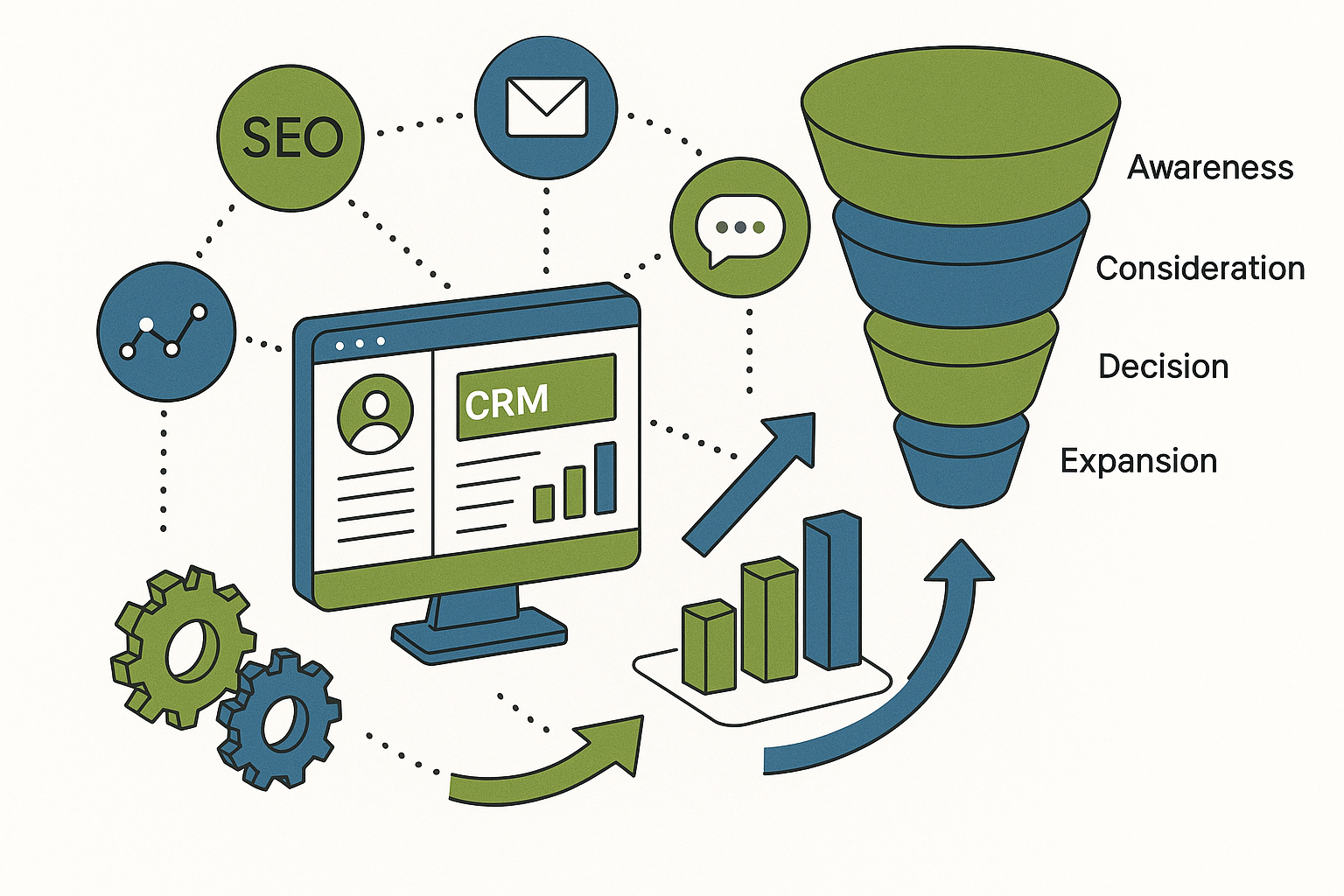

In today’s market, growth for professional services firms is inseparable from digital. Whether you are leading an accounting practice, managing a...