Selecting the Right AI Tools for Your Needs

As of mid-2025, large language models (LLMs) have significantly evolved, playing pivotal roles in professional environments like investment banking,...

3 min read

Christine Hollinden : May 12, 2025 7:45:00 AM

The accounting firm of 2030 will look drastically different than the firm of today. Compliance work will be largely automated. Advisory services will drive revenue. And the most valuable firms won’t just be technically sound — they’ll be strategic partners, tech-enabled, and embedded in the future of their clients’ businesses.

This isn’t a crystal-ball exercise. It’s about preparing for what’s already unfolding. Firms building toward this next-gen model are gaining a clear competitive edge — and leaving others behind.

So, what will it take to be a high-value firm by the end of the decade?

Compliance work will still exist, but that work will not be the foundation of firm value. AI and automation will continue to make traditional services more efficient and, perhaps, more commoditized.

Instead, growth will come from:

Clients won’t ask, “Can you file this?” They’ll ask, “What should I do next?” The firms that lead with insight — not just output — will win.

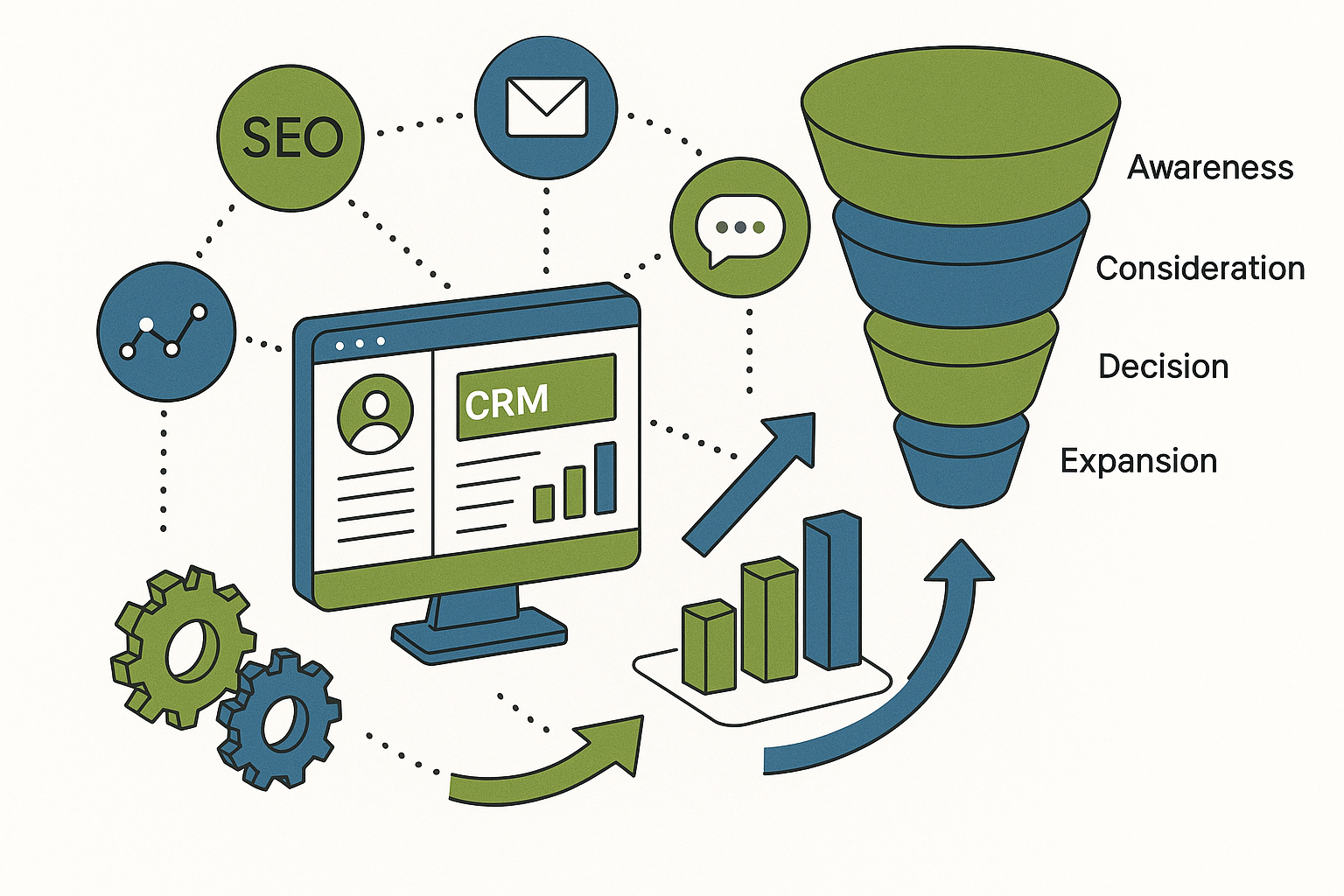

Waiting for the monthly or quarterly close is already on its way out. Real-time data is becoming the new norm.

Expect to see:

Manual processes are slow and backward facing. Firms that replace historic spreadsheets and silos with smart, forward-thinking, real-time insights will become indispensable. Isn’t that the true definition of “trusted advisor?”

Tomorrow’s firm will move beyond traditional accounting. The firm of the future will blend accounting acumen, financial data, business strategy, technology, and operational insights to help clients make stronger, faster, better decisions.

We're already seeing:

Clients will expect strategic insight from one firm versus fragmented support from multiple vendors. If you do need to bring in outside experts, they still expect you to be the quarterback.

The war for talent isn’t just ongoing, it’s evolved. A shrinking talent funnel. New career expectations.

To fill the gap, forward-thinking firms are:

If your firm still thinks it’s competing with “other firms,” think again. Your firm is competing with entire industries and top talent expects more than a cubicle and a time sheet.

The traditional CPA partnership model is being redefined. Private equity, national consolidators, and strategic investors are not only reshaping the organizational structure, but also reshaping firm leadership.

By 2030, expect:

Standing still isn’t neutral, it’s falling behind. Firms that modernize their structures will be better positioned to lead, grow, and attract capital, talent, and clients.

In a world where data and decisions are automated, human judgment and integrity matter more than ever.

High-value firms will serve as their clients’ ethical compass. That means:

Trust won’t be a soft skill; it will be a service line.

The future isn’t five years away; it is making landfall like a Cat 5 hurricane. From AI pilots to PE-backed platforms, from new leadership roles to next-gen service models, change is in motion and is cutting a path of destruction for those unwilling to change.

The 2030 future firms are already asking:

There’s no single playbook, but the direction is clear: advisory-led, digitally powered, and talent-smart create value.

From strategy and service line development to leadership alignment and market positioning, Hollinden helps accounting and advisory firms adapt, grow, and lead.

See how we can help.

The Hollinden Point of View brings you monthly insights tailored to helping you grow your firm.

As of mid-2025, large language models (LLMs) have significantly evolved, playing pivotal roles in professional environments like investment banking,...

In today’s market, growth for professional services firms is inseparable from digital. Whether you are leading an accounting practice, managing a...

In the high-pressure world of accounting, investment banking, and private equity, leaders make hundreds of decisions each day — some small, others...